CASE STUDIES

MITCHELLS & BUTLERS (M&B) IS ONE OF THE LARGEST OPERATORS OF RESTAURANTS, PUBS AND BARS IN THE UK, WITH A PORTFOLIO THAT INCLUDES A WIDE RANGE OF WELL-KNOWN BRANDS.

The Aim

To optimise the wine list of a leading brand within M&B, in order to:

• make selecting a wine easier for the consumer

• encourage higher spend and drive trade-up in wine

Our Approach

We used EYE-TRACKING TECHNOLOGY to compare and analyse participants’ response to a range of menu designs.

Participants’ eyes were tracked for linger time, focal point and movement, to identify features of most influence on a wine list.

The participants were asked both quantitative and qualitative questions, to assess each menu’s effectiveness. The recruited participants reflected the diverse customer base of the brand in question.

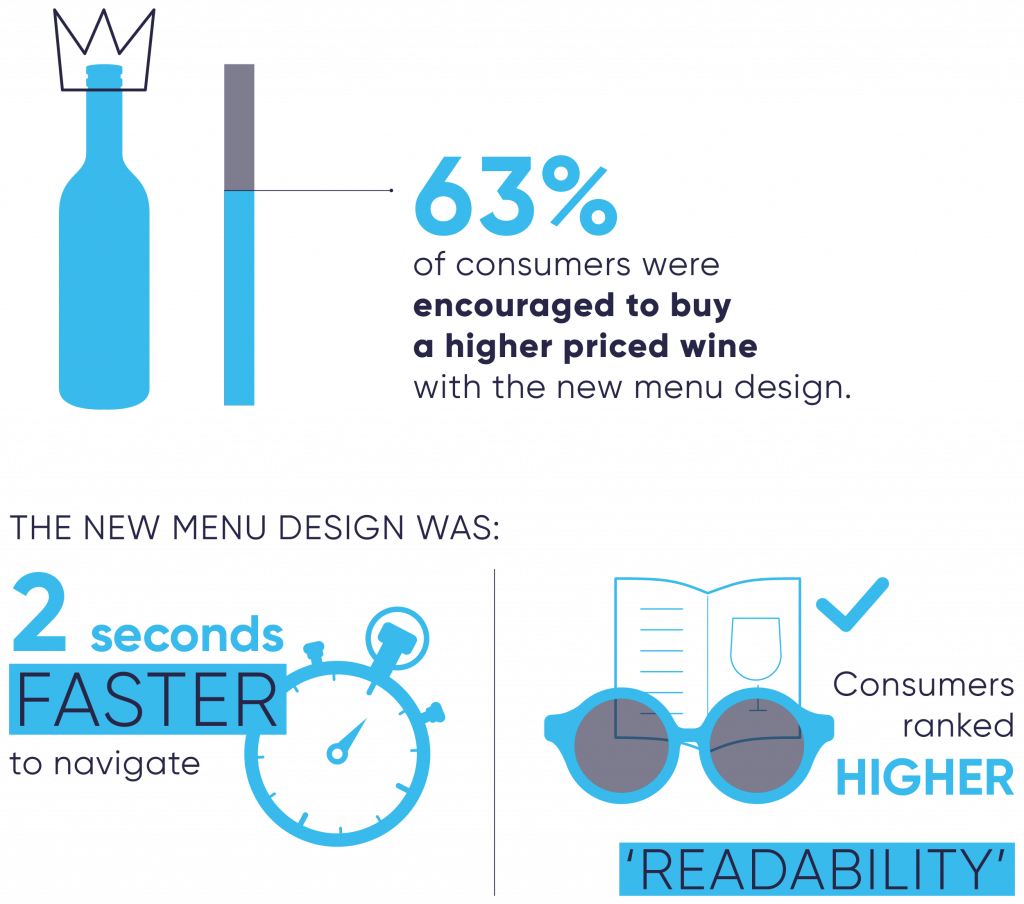

The Results

The findings were used to design a menu that was faster to navigate, easier to read and successful in driving trade-up.

The Aim

Optimised central wine range for procurement whilst underpinning the offer of each M&B fascia with Insight on their consumers

The Approach

Consumer-first approach, understanding both their price sensitivity and product preference, across different occasions, outlet types and geographies

The Results

We built the range in partnership with the procurement team to unlock the maximum spend in their On-Trade outlets

TENNENT’S IS SCOTLAND’S LEADING LAGER BRAND, WITH A HISTORY AT WELLPARK BREWERY THAT DATES BACK TO 1885.

The Aim

Tennent’s was interested in launching a new ‘light’ lager and required bespoke primary research to inform all aspects of product development and ensure a successful launch.

Our Approach

We conducted both quantitative and qualitative research with current light beer drinkers in order to better understand the opportunity.

The key aims of the quantitative research were to:

• understand why people drink light beer

• determine preferred taste profile for light beer

• identify preferred design attributes

• determine impact to Tennent’s brand

During the qualitative focus groups we conducted blind taste tests; delved deeper into the light beer occasion; and gathered design concept feedback.

WE SPOKE TO

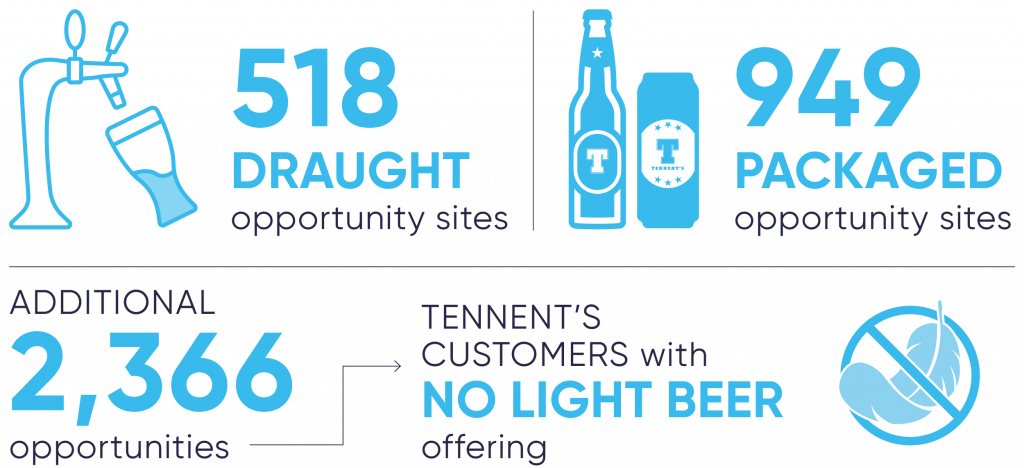

In order to ensure the new product landed successfully, we used  to inform site targeting opportunities across Scotland. We identified sites supplied by Tennent’s, that currently had no light beer offering. Moreover, we modelled the size of the prize for a light beer both On and Off Trade in Scotland.

to inform site targeting opportunities across Scotland. We identified sites supplied by Tennent’s, that currently had no light beer offering. Moreover, we modelled the size of the prize for a light beer both On and Off Trade in Scotland.

WE IDENTIFIED:

The Results

In February 2020, Tennent’s launched the lowest calorie light lager in Scotland. Thanks to the research findings, the product met the target consumer’s key criteria for a light beer: keeping the beloved red ‘T’ as part of the branding; adapting Tennent’s existing Gluten Free liquid – which was the preferred for taste against other competitors; and ensuring the brand messaging appealed to both its younger (low calorie) and older (low ABV) audience.

JUBEL IS A CRAFT BEER BRAND THAT BREW A RANGE OF FRUIT LAGERS, INSPIRED BY PEACH BEER TRADITION DISCOVERED IN THE FRENCH ALPS.

The Aim

Jubel wanted to grow its distribution points, specifically the On Trade in London and the South West. The target output was a shortlist of the right target sites for Jubel’s unique fruit beers to gain:

• initial listings

• second wave listings

• market growth listings

The Approach

We used our  knowledge to identify the target consumer segments for Jubel’s unique proposition.

knowledge to identify the target consumer segments for Jubel’s unique proposition.

identified sites that had high purchase levels of similar products; within areas that had a high concentration of their target consumer segments as defined by

identified sites that had high purchase levels of similar products; within areas that had a high concentration of their target consumer segments as defined by  .

.

A combination of  and Off Trade sales data enabled us to prioritise areas where the brand had higher penetration and existing brand awareness.

and Off Trade sales data enabled us to prioritise areas where the brand had higher penetration and existing brand awareness.

Stats

The Results

The output was a list of sites, by postcode area, ranked in order of the opportunity – giving the sales team a structured approach to new business targeting.